Council Tax bill explained

We send your Council Tax bill in February or March each year. Your tax bill contains a lot of information so we have explained how it is broken down and what it means:

Your bill explained

Your Council Tax bill will show details such as your current method of payment, the amount of each instalment and the due date by which it must reach us.

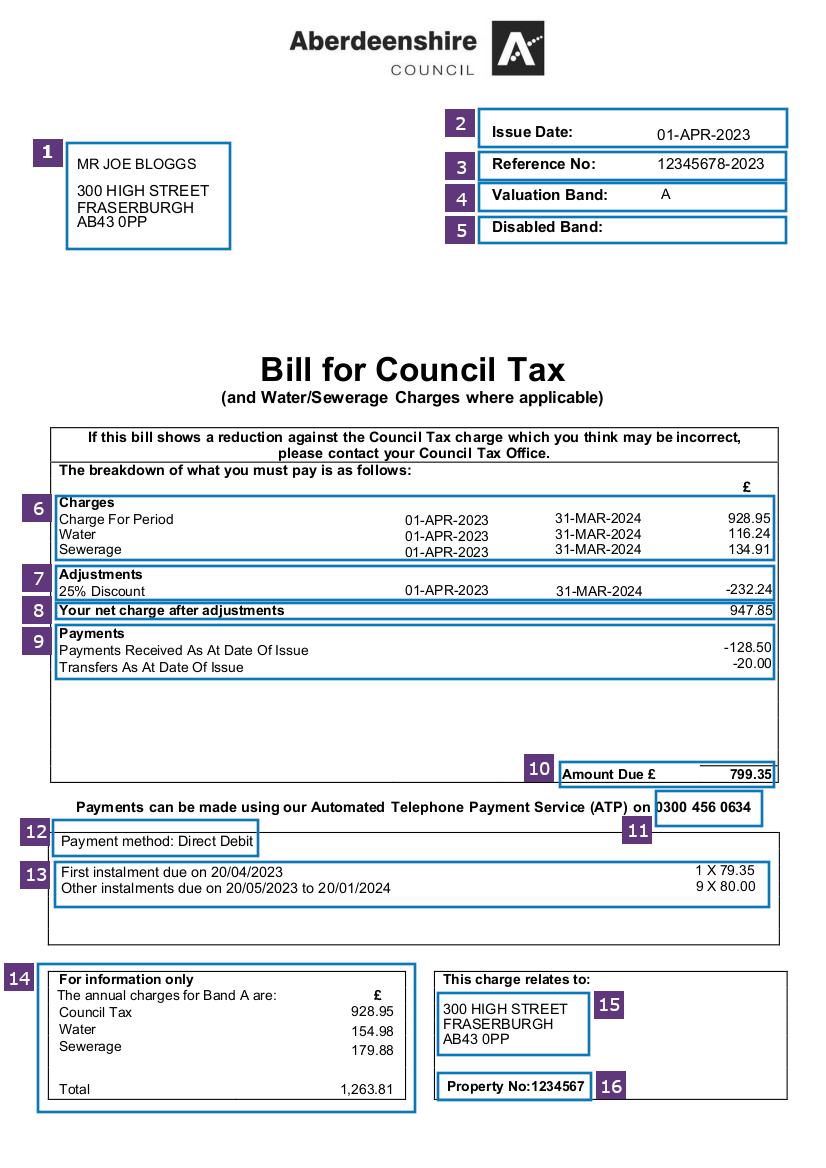

Below is an example Council Tax bill using sample data. We explain each numbered section in detail after the image. You can also read the back of a Council Tax bill (PDF 128KB) for more information.

At the top of the bill

1. Name of the person(s) liable for the paying the bill and contact address where the bill is issued to.

2. Date the Council Tax bill was issued.

3. Your Council Tax reference number - to help us deal with your query quickly, always quote this number when you contact us. At the end of this reference number you can find the financial year that your bill relates to (the last 4 digits).

4. Valuation band your property is in: the amount of Council Tax you pay is directly related to this.

5. Disability banding reduction if it has been awarded to your account.

Under the Bill for Council Tax section

6. Charges - this is broken down between Council Tax, water and sewerage (where applicable) and the period of liability these charges relate to.

7. Adjustments - any reductions that have been awarded to you for example Single Person Discount, Council Tax Reduction, long term empty. It also shows the period these adjustments relate to.

8. Net charge after adjustment and before any payments have been deducted.

9. Any payments made to the account or transfers of payments from other reference numbers or other financial years.

10. Amount due - this shows the balance payable for this bill.

11. Telephone number to use for paying by debit or credit card over the phone: 0300 456 0634.

13. Instalment dates and amounts due - payments should be made in accordance with these details.

At the bottom of the bill

14. Annual charge for the property band valuation shown on your bill. This will include the Council Tax, water and sewerage charge. To find out if you have been charged for water or sewerage, please look at the charges section on your bill.

15. Property address that the Council Tax bill relates to.

16. Property reference number that the Council Tax bill relates to.

Who pays the bill

One or more persons can be responsible for paying the Council Tax bill.

Person(s) named on the Council Tax bill

The person or people named on the front of the bill are responsible for paying the Council Tax for the property. This will be either:

- the resident owner - someone who owns the property and lives in it

- a resident tenant - someone who rents the property and lives in it

- a sub-tenant - someone who rents the property and lives in it

- a resident

- the owner - if the property is not subject to a lease and no-one lives in the property

Two or more person(s) jointly liable

If there are two or more owners or tenants, they will be jointly responsible for paying the Council Tax, even if we only send the bill to one of them.

You are both, individually and together, responsible for making sure that your Council Tax is paid in full if:

- you have a husband or wife, or you live with someone as if you were married

- you and someone else are joint owners or tenants of a property

This includes same-sex couples who have entered into a civil partnership or those who live together as a couple but who have not entered into a civil partnership.

View your bill and balance online

With the Council Tax self-service you can:

- Switch to paperless billing

- View your account summary

- Check your balance, instalments and payments

- View and download bills and reminder notices